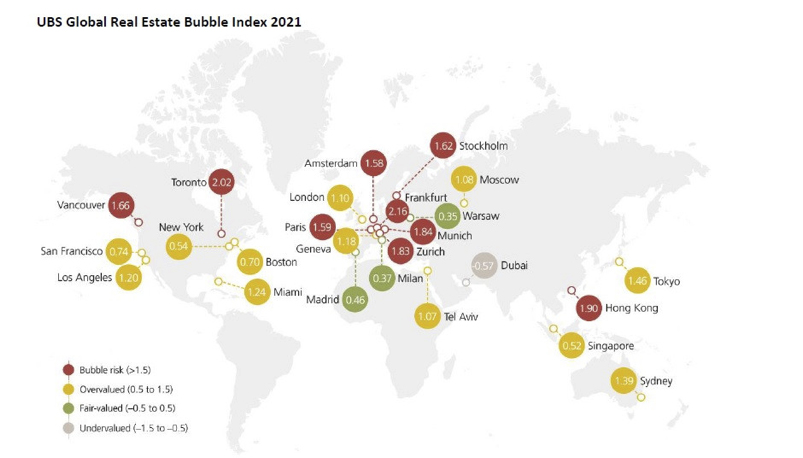

According to the UBS Global Real Estate Bubble Index 2021, Milan would not be at risk of a real estate bubble in 2021, as well as Madrid and Warsaw. But the other cities of the world, except Dubai, are at risk: here are in particular where the new real estate bubble could burst.

Real estate bubble 2021, the cities most at risk

The annual study conducted by the Chief Investment Office of UBS Global Wealth Management indicates that the risk of real estate bubbles on average has increased over the past year, as has the possibility that the price collapse could be severe.

In particular, it is Frankfurt, Toronto and Hong Kong that are risking the most in 2021. Munich and Zurich are not faring better, while both Vancouver and Stockholm have returned to the risk zone together with Amsterdam and Paris in the top ten.

In the territory of overvaluation of real estate prices, all the US cities valued – Miami (which replaces Chicago in this year’s index), Los Angeles, San Francisco, Boston and New York – in the company of Tokyo, Sydney, Geneva, London, Moscow , Tel Aviv and Singapore.

No real estate bubble in 2021 in Milan

Madrid, Milan and Warsaw are the three cities that stand out for having valuations perfectly in line with the market. Rigid and long lockdowns have in fact brought the recovery of the real estate market to a halt. According to experts, a period of sustained and solid economic growth would be needed to cause a real estate boom in these cities. Dubai is even underestimated, the only city classified in a lower category than last year.

Matteo Ramenghi, Chief Investment Officer of UBS WM Italy commented: “In a global context, and especially when compared with the rest of Europe, the residential real estate market in Milan continues to offer investors attractive valuations. The foundations of the market remain solid in view of the decline in public debt yields which also pushed mortgage rates down and the increase in household savings during the pandemic. The redevelopment of buildings, also thanks to the considerable tax incentives, helps to keep the market dynamic in the medium term. In the long term, further growth of the sector will depend on the economic and demographic trend of the city. ”

October 18, 2021

Source: Idealista news